|

Spring 2003 (11.1)

Pages

74-79

BTC Section - Pipeline Construction Begins

Beginning

the Journey Westward

Above: Winter conditions near Erzurum in eastern

Turkey. Pipeline construction must wait until the snow has melted.

This April, the eagerly

awaited Baku-Tbilisi-Ceyhan (pronounced jey-HAN) (BTC) oil pipeline

will move one more step closer to reality with the start of construction

at sites in Azerbaijan, Georgia and Turkey along the 1,760-km

route. It has been more than 10 years since the idea was first

proposed.

For the past nine months, the efforts of the BTC consortium have

been focused on planning: creating a project team, carrying out

preliminary environmental and social impact assessments, designing

the pipeline, raising financing, acquiring land, mobilising contractors,

hiring and training workers, defining health, safety and environmental

standards and ensuring that pipe was ordered, manufactured to

specification and delivered on time.

Left: A key environmental benefit offered

by the BTC project is reduced growth in the future volume of

tanker traffic having to navigate the narrow and congested Turkish

Straits in the world heritage city of Istanbu, Turkey. Left: A key environmental benefit offered

by the BTC project is reduced growth in the future volume of

tanker traffic having to navigate the narrow and congested Turkish

Straits in the world heritage city of Istanbu, Turkey.

With most of these efforts

firmly on track, the spotlight has now shifted to the complex

practical and technical challenges involved in actually laying

a pipeline that will cross three countries, bisect some of the

more isolated and earthquake-prone regions to be found in Europe

or Asia, rise to a height of 2,800 metres and stretch as far

as the distance from London to Gibraltar or from New York to

Miami.

Construction of any pipeline is a sequential process involving

a number of distinct operations undertaken by specialised and

general machinery that is known as the "construction spread."

Within each spread there are eight or nine teams, each doing

different tasks. A typical sequence of activities includes surveying,

preparing the land, stringing out the pipeline sections along

the route, excavating the trench, welding and laying the pipeline,

backfilling the trench with soil, and reinstating the land as

close as possible to its original condition.

Beginning in April 2003, at least one construction spread will

be active at any given time in each country, supported by special

section crews that will be responsible for work at hundreds of

river crossings and other places requiring specialised installation

equipment and techniques.

In Azerbaijan, one spread will start at the Sangachal terminal

on the shores of the Caspian Sea and then move in a westerly

direction to the border of Georgia 442 km away. Much of the terrain

is flat and semi-arid. That section of the route is expected

to be completed in about 12 months.

In Georgia the 248 km-long corridor bisects flat terrain for

two-thirds of the way before moving through a zone that stretches

nearly 100 km across a region notable for its remoteness, poor

weather, height (at some points the route rises above 2,500 metres)

and hard rock conditions.

Left: Typical scene in eastern Anatolia. Left: Typical scene in eastern Anatolia.

In Turkey, which accounts

for about 60 percent of the pipeline corridor (1,070 km), half

of the route goes through uplands above a height of 1,500 metres.

Weather conditions could be a problem here in winter - not to

mention the route must also move across two of the world's most

active earthquake zones.

Vast quantities of pipe will be used-39,000 sections of pipe

each 11.6 metres long in the Azerbaijan section alone. All the

pipes needed for Azerbaijan and Georgia are being manufactured

in Japan by Sumitomo before being covered in a special protective

coating in Malaysia. Transporting these pieces by sea to the

region will take nearly seven months, with each vessel carrying

enough pipe to cover a 25 - to 30-km section of the route.

The first actual laying of the pipe is scheduled for June 2003.

Depending on local conditions, an average of 1,000-1,500 metres

of pipe will be laid per spread, per country, per day. The period

between initial excavation and the reinstatement of right of

way across the pipeline corridor is expected to take between

two and three months. Reinstatement will include the removal

of all construction facilities, such as workers' camps, pipe

storage yards and temporary access roads.

At full capacity, the line will transport up to one million barrels

of oil a day. Seven intermediate pump stations will be built

- one in Azerbaijan, two in Georgia and four in Turkey, where

a pressure reduction station will also be located. Around 100

block valve stations will be installed to improve safety and

ease maintenance. The line will use several pipe diameters, varying

between 34 and 46 inches. These pipes are protected against external

corrosion by a three-layer, high-density polyethylene coating.

"This is a huge project by any standard," says Phil

Allison, Technical Director of the BTC Company. "The overall

environment is difficult and the timeframe is very tight. It's

not an easy job, and we're taking a big step forward in several

ways, especially in terms of training, safety and care of the

environment."

Left: Typical scene in eastern Anatolia. Left: Typical scene in eastern Anatolia.

Add the overriding need

for tight security and the best possible relationships with hundreds

of rural communities along the route, and the scale of the challenge

is clear that the BTC construction crews are facing as they begin

work. For the moment, the emphasis is squarely on getting a hugely

complex organisation working safely and efficiently to its full

potential.

Acquiring the Land

Rights

The process of acquiring about 6,000 hectares of land needed

permanently or temporarily to permit the building of the BTC

pipeline began towards the end of 2001. Since then, much progress

has been made, but much still remains to be accomplished.

No one will be forced to leave their homes. However, an estimated

35,000 individual landowners or users, and more than 22,000 parcels

of land, will be affected by the land acquisition programme.

Under the terms of the Intergovernmental Agreement (IGA) and

Host Government Agreements (HGAs), compensation will be paid

to everyone. An appeals system, involving national courts, if

necessary, has been built into the procedures. The precise terms

will vary, reflecting differences in land ownership laws and

customs in each of the host countries.

No project of this scale or complexity has been attempted in

the region before. Land reform is in process in Azerbaijan and

Georgia, and the land market in these countries has not developed

very much yet, making it a complex task to determine compensation.

In Turkey, ownership has sometimes proved hard to establish as

some landowners live in cities or abroad and many of the land

parcels have multiple owners. In addition, land along the length

of the route is being classified according to its potential future

value as well as its current agricultural yields.

Despite these challenges, significant progress has been recorded

in the past 15 months. During this period, land acquisition teams

have been recruited and trained in each country and comprehensive

land inventories have been drawn up.

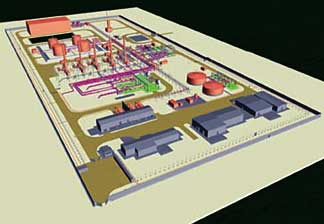

Left: Computer generated image of one of

the BTC pumping stations. Left: Computer generated image of one of

the BTC pumping stations.

In Azerbaijan, more

than 4,150 individual agreements and nearly 100 agreements with

municipalities will be signed by the end of the process. In Georgia

the acquisition process was concentrated initially on the difficult

mountainous region to allow construction to begin in the summer

months. In Turkey much of the land along the route is state-owned.

In the areas where it is not, a major drive is now underway to

determine legal title.

As of March 2003, approximately 85 percent of the individual

land lease agreements needed in Azerbaijan, and 50 percent of

those in Georgia had been settled. Most of the compensation -

which will be paid to recipients free of taxes and government

or legal fees - is expected to be made by mid-2003 directly through

the various national banking systems.

Once each construction phase is completed along the route, and

the land above the pipe reinstated to its original condition,

the landowner or user will be able to farm the corridor above

the line.

On average, the pipeline will be buried at a depth of one metre

below the surface. Shallow-rooted crops and shrubs will be permitted,

but there will be restrictions on tree-planting, deep excavation

and ploughing. No structures will be permitted to be built close

to the pipeline corridor. The BTC Company will retain control

of the corridor during the entire construction phase to permit

access for pipeline testing and commissioning.

Enhancing Safety

Approximately 50,000 vessels a year navigate the narrow stretch

of water known as the Turkish Straits, which bisect the city

of Istanbul and link the Black Sea to the Sea of Marmara and

eventually the Mediterranean. In addition to the tankers and

ships that transit the 31-km-long Straits, there are ferries,

fishing boats, pleasure boats and tourist cruisers, which jostle

for space in the narrow waters.

Left: BTC land acquisition teams meeting

villagers in eastern Turkey. Left: BTC land acquisition teams meeting

villagers in eastern Turkey.

During the last 24 years

more than 300 accidents have been documented in the Bosphorus,

resulting in about 100 deaths.

Two major oil spills took place in 1979 and 1994. In 2002 approximately

910 million barrels of oil - crude and refined products - passed

through the Straits. With the growth of oil production in Russia,

Azerbaijan and Kazakhstan, this figure will certainly increase

if nothing changes.

In 1994 rules were drawn up to deal with this situation including

a mandate related to the vessels' movements according to their

length. However, collisions are still averaging about three a

year, and a large number of vessels transit without proper insurance.

Since the collapse of the Soviet Union, more nations are using

the Bosphorus, making it harder than ever to get the broader

agreement necessary to improve safety, given the status of the

Turkish Straits as an international waterway.

Constructing the BTC pipeline is now seen as one solution of

what must be a multi-faceted response to this situation. By 2008,

when the pipeline is working at full capacity, one million barrels

of oil a day will be flowing through the line to the Ceyhan terminal

- the equivalent of several tanker transits a day through the

Straits. Over the course of the 40-year design life of the BTC

pipeline, this number will add up to around 30,000 transits,

depending on the volume of oil actually moved by the pipeline

and the application of regulations governing the size of vessels

and number of shipping movements permitted through the Straits.

At the same time, the BTC project is acting as a catalyst for

efforts to develop an integrated oil spill response capability

in the Caspian and Black Sea regions. According to a study commissioned

by a consortium of oil companies, including BP, no quick fixes

are possible. "The oil spill risks in the region are significant

today and will increase," observes Study Manager, Peter

Taylor of IPIECA (International Petroleum Industry Environment

Conservation Association). "A major incident could cause

both short- and long-term disruption across the oil industry

and throughout the region."

Left: Pipelines emerge from the ground at

pumping stations, where access is provided for devices which

travel through the line for maintenance and inspection. Left: Pipelines emerge from the ground at

pumping stations, where access is provided for devices which

travel through the line for maintenance and inspection.

As a result, the study

has recommended 22 specific actions based on ideas to promote

and improve cooperation between governments, international organizations

and the oil industry in the region. Implementing these recommendations

over five years is likely to cost around $6 million.

Financing the Pipeline

Finding the money to fund the Baku-Tbilisi-Ceyhan pipeline has

turned into a global initiative involving scores of international

financial institutions (IFIs) and commercial banks from around

the world. In an unusual move that reflects its confidence in

the viability of the project, the BTC consortium has decided

to provide the necessary funds to allow construction work to

progress to the end of 2003 before all the loans are finalised.

The Baku-Tbilisi-Ceyhan project is commercially robust, and the

BTC Company expects to raise the financing it needs at commercial

rates reflecting the current risk premium for investing in the

region. No bank or other financial institution will be subsidising

the link.

The actual construction costs of the project - around $3 billion

- will be underpinned by more than $1 billion provided by the

sponsoring companies in the form of equity investment. The balance

is expected to come in the form of debt from a variety of IFIs

together with shareholder loans. All told, about 30 percent of

the funds will be provided on equity terms and 70 percent on

debt terms.

Left: BTC will traverse agricultural land

like this in western Azerbaijan. Left: BTC will traverse agricultural land

like this in western Azerbaijan.

According to John Wingate

of Statoil, who heads the drive by the BTC Company to raise financing

for the project, the immediate priority is to reach common terms

with all potential lenders. After that, the environmental information

public disclosure process of the IFI is expected to continue

for several months. The governing boards of these agencies will

then vote on the specific financing proposals.

Despite the complexity, BTC shareholders are optimistic that

the financing can be completed on schedule. In the words of David

Woodward, President of BP Azerbaijan: "This is one of the

most complicated export financing projects ever undertaken. But

we're very confident that everything will be finalized by the

end of the year."

A wide variety of groups are involved in this process. The first

group includes the IFIs of the International Finance Corporation

(the IFC is an arm of the World Bank) and the European Bank for

Reconstruction and Development (EBRD) which have specific mandates

to support and stimulate development. The second group involves

national ECGAs (Export Credit Guarantee Agencies) such as the

U.S. Export-Import Bank and Britain's Export Credit Guarantee

Department, which effectively underwrite lending by commercial

banks.

A third group is made up of specialist organizations such as

OPIC (Overseas Private Investment Corporation - an independent

U.S. government agency) - and its Japanese equivalent, the Nippon

Export and Investment Insurance (NEXI), which provide political

risk insurance to enhance commercial activity by their national

companies or banks. Finally, there are commercial banks. At the

start of construction in April 2003, four banks are leading negotiations

with the BTC consortium, but as many as 30 may eventually lend

to the project.

Left: Jan Leschly, Caspian Development Advisory

Panel (CDAP). Left: Jan Leschly, Caspian Development Advisory

Panel (CDAP).

Why is the BTC Company

raising money through sources that might end up being more expensive

than normal for infrastructure projects of this sort? One reason

is that the involvement of IFIs such as the EBRD and the IFC,

with their stringent environmental and ethical disclosure requirements,

will provide further assurance that the BTC project is carried

out to the highest standards. Also, the consortium desires to

operate as a single entity. In Wingate's words: "It's a

way of enabling maximum participation by a number of important

state-owned companies in the project.

Exporting Gas from

the Region

In a decision made at the end of February, which had wide significance

for the BTC project, seven partners in the Shah Deniz gas and

condensate field in the Azerbaijan sector of the Caspian Sea

agreed to commit a total of $3.2 billion to the construction

of another East-West energy corridor to Turkey and beyond.

The new company, known as the South Caucasus Pipeline Company

(SCPC), is comprised of the same seven partners as the Shah Deniz

consortium: BP (25.5%), Statoil (25.5%), SOCAR (10%), LUKAgip

(10%), NICO (NaftIran Intertrade Co.) (10%), TotalFinaElf 10%

and TPAO (Turkey's State Oil Company) (9%). SCPC will have overall

control of the pipeline. BP will be responsible for construction

and operation of the SCPC facilities, whereas Statoil will take

charge of the commercial affairs and administration.

This development, known as Stage 1, includes an offshore platform,

wells and subsea pipelines in the Caspian, onshore gas and condensate

processing facilities at the Sangachal terminal, and a 690 km

long, $900 million gas pipeline from the terminal near Baku via

Georgia to the Turkish border.

The pipeline is to be constructed along the same route as the

BTC oil pipeline in order to minimise the environmental and social

impact of the two projects and to achieve capital and operational

cost-savings. Construction is scheduled to commence in 2004 and

will be completed in time to deliver First Gas to Turkey in 2006.

Environmental and Social Impact Assessments (ESIAs) for the Azerbaijan

and Georgian sections of the SCP route, as well as for the related

offshore/onshore facilities, have already been conducted and

approved. Safety will be a top priority and an important criterion

in the selection of contractors.

During construction, the SCP project will create 4,200 direct

local jobs and an additional 1,300 jobs related to construction

of the onshore and offshore facilities. A $7.5 million community

investment programme will be implemented in Azerbaijan and Georgia

as well as a $4 million environmental investment programme.

Checking the Standards

A number of key safeguards have been built into the BTC project

to ensure that it sets new standards for responsible development.

Among the most important is the creation of an independent external

grouping, the Caspian Developments Advisory Panel (CDAP), with

a three-year remit to provide objective advice on the pipeline's

economic, social and environmental impact on the three host countries

- and in particular on areas closest to the route.

Chaired by Jan Leschly, who is chairman and partner of Care Capital

and former Chief Executive of SmithKline Beecham, the four-person

panel is empowered to comment on all oil and gas developments

broadly related to the BTC project, including the Azeri-Chirag-Gunashli

(ACG) oilfield, the Shah Deniz gas field and the South Caucasus

gas export pipeline (SCP).

Danish-born Jan Leschly is a member of the Board of Directors

of American Express, Viacom Inc. and the Maersk Group. Care Capital

is a $100 million life sciences venture fund. Other panel members

include Jim McNeill, a Canadian diplomat and policy advisor on

environmental and energy issues who is Chairman of the International

Institute for Sustainable Development and a former member of

the UN's World Commission on Environment & Development; Stuart

Eizenstat, Deputy Secretary of the Treasury during the Clinton

administration; and Mohamed Sahnoun, a former ambassador and

adviser to the President of Algeria and member of the UN World

Commission on Environment & Development who is now associated

with the International Development Research Centre.

During the first half of 2003, the panel is scheduled to visit

all three countries hosting the pipeline, including locations

along the route, and to consult with community leaders, government

officials, representatives of non-governmental organizations

and others as it sees fit. It will use its first report later

this year as a baseline for follow-up work to be done in the

next two years.

The panel will be funded by BP, which operates BTC, ACG (Azeri,

Chirag, deep-water Gunashli) and Shah Deniz. It will have its

own Secretariat, be assisted by local representatives in each

country and report directly to Lord Browne, Chief Executive Officer

of BP. Its reports will be made public together with BP's responses.

The panel can be contacted via e-mail at CDAP@caspsea.com.

Back to Index

AI 11.1 (Spring 2003)

AI Home

| Search | Magazine

Choice

| Topics

| AI Store | Contact us

Other Web sites

created by Azerbaijan International

AZgallery.org | AZERI.org | HAJIBEYOV.com

|